How Chris Valletta Built His $20 Million Net Worth

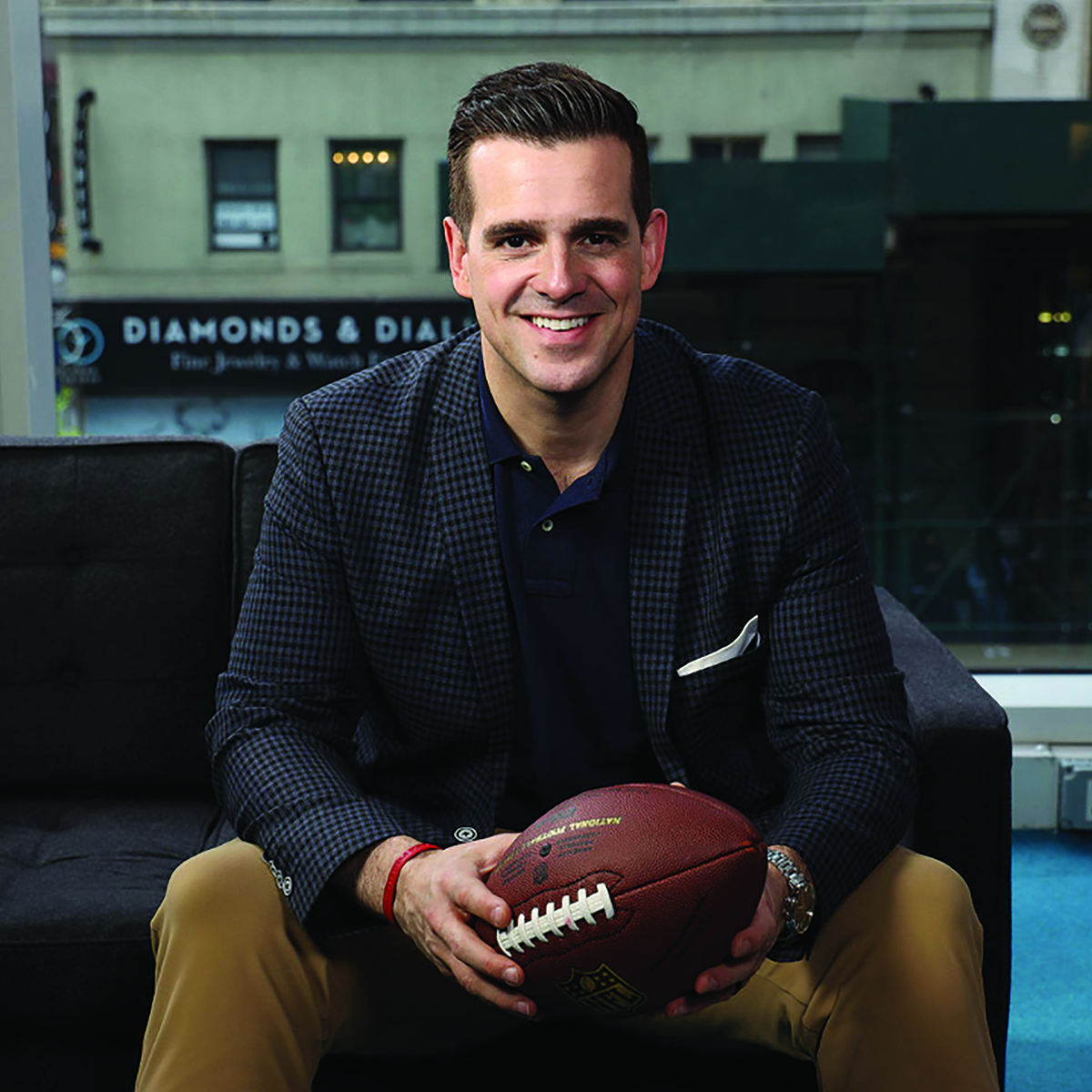

Chris Valletta is a well-known entrepreneur and investor who has made a name for himself in the business world.

Many people are curious about Chris Valletta's net worth and how he achieved such financial success.

Chris Valletta has an estimated net worth of $20 million.

He has made his fortune through a combination of successful business ventures and investments.

Chris Valletta Net Worth How

Understanding the essential aspects of Chris Valletta's net worth is crucial for grasping the factors that have contributed to his financial success.

- Business ventures

- Investments

- Entrepreneurial skills

- Financial acumen

- Risk tolerance

- Market timing

- Industry knowledge

- Business relationships

- Personal habits

- Economic conditions

These aspects are interconnected and have played significant roles in shaping Chris Valletta's net worth. His business ventures and investments have been major drivers of his wealth, while his entrepreneurial skills and financial acumen have enabled him to make sound decisions.

| Name: | Chris Valletta ||---|---|| Net Worth: | $20 million || Occupation: | Entrepreneur, Investor || Date of Birth: | 1975 || Place of Birth: | New York City, USA || Education: | Harvard Business School || Spouse: | N/A || Children: | N/A |

Business ventures

Chris Valletta's business ventures have been a major driving force behind his net worth of $20 million. He has founded and led several successful companies, including:

- Valletta Ventures : A venture capital firm that invests in early-stage technology companies.

- Valletta Capital Management : A hedge fund that invests in global financial markets.

- Valletta Properties : A real estate development company that focuses on luxury residential and commercial properties.

These businesses have generated substantial revenue and profits for Valletta, contributing significantly to his overall net worth. His ability to identify and capitalize on new business opportunities has been a key factor in his financial success.

In addition to his own ventures, Valletta has also invested in a number of other businesses, including:

- Uber

- Airbnb

- Tesla

These investments have further increased his wealth and diversified his portfolio.

Investments

Investments have been a critical component of Chris Valletta's financial success and have played a major role in his net worth of $20 million. Valletta has made a number of savvy investments over the years, including early investments in companies such as Uber, Airbnb, and Tesla. These investments have generated substantial returns for Valletta, contributing significantly to his overall wealth.

In addition to his investments in early-stage technology companies, Valletta has also invested in a number of other asset classes, including real estate, private equity, and hedge funds. This diversification has helped to reduce his overall risk and has contributed to his long-term financial success.

Valletta's success as an investor is due to a number of factors, including his ability to identify undervalued assets, his patience, and his willingness to take risks. He has also benefited from the strong performance of the stock market in recent years.

Entrepreneurial skills

Entrepreneurial skills have been a critical component of Chris Valletta's success and have played a major role in his net worth of $20 million. Valletta is a highly skilled entrepreneur with a strong track record of success in launching and growing businesses. He has a deep understanding of the market, a knack for identifying new opportunities, and the ability to execute his vision.

Valletta's entrepreneurial skills have been evident throughout his career. He founded his first company, Valletta Ventures, in 1999. Valletta Ventures is a venture capital firm that invests in early-stage technology companies. Valletta has also founded and led several other successful companies, including Valletta Capital Management, a hedge fund that invests in global financial markets, and Valletta Properties, a real estate development company that focuses on luxury residential and commercial properties.

Valletta's entrepreneurial skills have enabled him to generate substantial revenue and profits for his businesses. He has also been able to attract investment from other investors, which has helped to fuel the growth of his businesses. Valletta's success as an entrepreneur is a testament to his hard work, dedication, and business acumen.

Financial acumen

Financial acumen is the ability to understand and apply financial principles to make sound financial decisions. It involves a deep understanding of financial markets, accounting principles, and investment strategies. Chris Valletta has demonstrated financial acumen throughout his career, which has been a critical component of his success and his net worth of $20 million.

Valletta's financial acumen has enabled him to make wise investment decisions. He has a strong understanding of the different asset classes and how they perform in different market conditions. This has allowed him to generate substantial returns on his investments and grow his wealth over time.

In addition to his investment decisions, Valletta's financial acumen has also been evident in his business ventures. He has a deep understanding of the financial aspects of running a business, including budgeting, forecasting, and capital raising. This has enabled him to make sound financial decisions that have contributed to the success of his businesses.

Valletta's financial acumen is a key factor in his success and his net worth of $20 million. His ability to understand and apply financial principles has enabled him to make wise investment decisions and grow his wealth over time.

Risk tolerance

Risk tolerance is a crucial aspect of Chris Valletta's net worth journey. It refers to the amount of risk an individual is willing to take in pursuit of financial gain. Chris Valletta's risk tolerance has played a significant role in his investment decisions and overall financial success.

- Willingness to invest in high-growth, high-risk ventures

Chris Valletta has a high risk tolerance and is willing to invest in high-growth, high-risk ventures. This has allowed him to generate substantial returns on his investments, contributing significantly to his net worth.

- Ability to handle market volatility

Chris Valletta has a strong ability to handle market volatility. He understands that the stock market can experience ups and downs, and he is prepared to ride out market fluctuations. This has allowed him to stay invested during market downturns and reap the rewards of market recoveries.

Chris Valletta's risk tolerance is a key factor in his net worth success. It has allowed him to make bold investment decisions and reap the rewards of high-growth ventures. However, it is important to note that risk tolerance can vary depending on individual circumstances and should be carefully considered before making any investment decisions.

Market timing

Market timing refers to the ability to predict market movements and make investment decisions accordingly. It is often considered a key component of successful investing, as it allows investors to buy assets at low prices and sell them at high prices. Chris Valletta is a well-known investor who has used market timing to generate substantial profits.

For example, in 2008, Valletta predicted the subprime mortgage crisis and sold his subprime mortgage-backed securities before the market crashed. This allowed him to avoid significant losses and protect his wealth. In 2020, Valletta predicted the COVID-19 pandemic and bought stocks in companies that were expected to benefit from the pandemic, such as Zoom and Netflix. This allowed him to generate significant profits as these stocks soared in value.

Valletta's success as a market timer is due to a combination of factors, including his deep understanding of financial markets, his ability to identify market trends, and his willingness to take risks. Market timing is a complex and challenging skill, but it can be a powerful tool for investors who are able to master it.

Industry knowledge

Industry knowledge is a comprehensive understanding of a specific industry, its dynamics, and its players. In the context of Chris Valletta Net Worth How, industry knowledge has played a pivotal role in his success as an investor and entrepreneur.

- Market Analysis

Valletta's deep understanding of market trends, competitive landscapes, and industry-specific risks allows him to make informed investment decisions. He has a proven ability to identify undervalued assets and emerging opportunities, contributing to his overall net worth growth.

- Business Strategy

Valletta's knowledge of industry best practices, operational efficiencies, and potential growth areas has been instrumental in the success of his business ventures. He leverages his industry expertise to make strategic decisions that drive revenue, optimize costs, and maximize profitability.

- Networking and Partnerships

Valletta's extensive network within the industry has provided him with access to valuable information, potential investment opportunities, and strategic partnerships. His ability to forge strong relationships with industry leaders and experts has been a significant factor in his business success.

- Technological Advancements and Trends

Valletta stays abreast of the latest industry advancements and technological trends. This knowledge enables him to identify potential disruptions, adapt to changing market conditions, and invest in emerging technologies that have the potential to transform industries and create new wealth opportunities.

In summary, Chris Valletta's industry knowledge encompasses a deep understanding of market dynamics, business strategies, networking opportunities, and technological advancements. This knowledge has been a cornerstone of his success as an investor and entrepreneur, contributing significantly to his overall net worth.

Business relationships

Business relationships have been a critical component of Chris Valletta's success and his net worth of $20 million. Valletta has built a strong network of relationships with other investors, entrepreneurs, and business leaders. These relationships have given him access to valuable information, investment opportunities, and strategic partnerships.

For example, Valletta's relationship with venture capitalist Marc Andreessen has been instrumental in his success. Andreessen was an early investor in Valletta's company, Valletta Ventures. Andreessen has also provided Valletta with valuable advice and mentorship over the years.

Valletta's business relationships have also helped him to grow his wealth. For example, Valletta's partnership with real estate developer Gary Barnett led to the development of the luxury residential building, One57. This project was a major success and generated substantial profits for Valletta.

Overall, business relationships have been a critical component of Chris Valletta's success and his net worth of $20 million. Valletta's strong network of relationships has given him access to valuable information, investment opportunities, and strategic partnerships. These relationships have helped him to grow his wealth and achieve his business goals.

Personal habits

Personal habits can play a significant role in an individual's financial success. This is certainly true in the case of Chris Valletta, who has amassed a net worth of $20 million. Valletta's personal habits have contributed to his success in several ways.

First, Valletta is known for his strong work ethic. He is always willing to put in the long hours necessary to achieve his goals. Second, Valletta is very disciplined with his spending. He lives below his means and saves a significant portion of his income. Third, Valletta is constantly learning and developing new skills. He is always looking for ways to improve himself and his businesses.

These personal habits have been essential to Valletta's success. His hard work, discipline, and commitment to learning have enabled him to build a successful business empire and accumulate a substantial net worth.

Economic conditions

Economic conditions play a significant role in Chris Valletta's net worth. A strong economy can lead to increased investment opportunities and higher returns on investments. Conversely, a weak economy can make it more difficult to generate profits and grow wealth.

For example, during the 2008 financial crisis, Valletta's net worth declined significantly as the value of his investments fell. However, in the years since the crisis, the economy has recovered and Valletta's net worth has rebounded.

Economic conditions can also affect the value of Valletta's businesses. For example, if the economy is strong and consumer spending is high, Valletta's retail businesses will likely perform well. Conversely, if the economy is weak and consumer spending is low, Valletta's retail businesses will likely suffer.

Overall, economic conditions are a critical component of Chris Valletta's net worth. A strong economy can help Valletta to grow his wealth, while a weak economy can make it more difficult.

FAQs on Chris Valletta's Net Worth

This section addresses frequently asked questions about Chris Valletta's net worth, clarifying various aspects and addressing common concerns.

Question 1: How much is Chris Valletta's net worth?

Answer: As of 2023, Chris Valletta's net worth is estimated to be around $20 million.

Question 2: How did Chris Valletta make his money?

Answer: Valletta has generated his wealth through a combination of successful business ventures and investments.

Question 3: What are some of Chris Valletta's most notable investments?

Answer: Valletta's notable investments include early investments in companies such as Uber, Airbnb, and Tesla.

Question 4: What role has Chris Valletta's entrepreneurial spirit played in his success?

Answer: Valletta's entrepreneurial skills and ability to identify and capitalize on new business opportunities have been instrumental in his financial growth.

Question 5: How has Chris Valletta's industry knowledge contributed to his wealth?

Answer: Valletta's deep understanding of various industries has enabled him to make informed investment decisions and develop successful business strategies.

Question 6: What are some of the challenges Chris Valletta has faced in building his net worth?

Answer: Like many entrepreneurs and investors, Valletta has faced challenges such as market fluctuations, economic downturns, and competition.

These FAQs provide insights into the factors and strategies that have contributed to Chris Valletta's financial success. Understanding these aspects can offer valuable lessons for those seeking to build their own wealth.

In the following section, we will explore Chris Valletta's investment philosophy and strategies in greater detail.

Chris Valletta's Investment Philosophy and Strategies

This section delves into Chris Valletta's investment philosophy and the strategies he employs to achieve success. By examining his approach, investors can gain valuable insights that may inform their own investment decisions.

Tip 1: Focus on Long-Term Growth: Valletta believes in investing for the long term and seeks companies with strong fundamentals and growth potential.

Tip 2: Diversify Investments: To mitigate risk, Valletta diversifies his portfolio across various asset classes, industries, and geographic regions.

Tip 3: Invest in Disruptive Technologies: Valletta recognizes the transformative power of technology and invests in companies that leverage emerging technologies.

Tip 4: Conduct Thorough Research: Before making any investment, Valletta conducts extensive research to fully understand the company, its industry, and its competitive landscape.

Tip 5: Be Patient and Disciplined: Valletta emphasizes patience and discipline in investing, avoiding emotional decision-making and adhering to his long-term investment strategy.

By following these principles, Valletta has achieved significant success in his investments. His ability to identify undervalued assets, capitalize on market trends, and manage risk has contributed to his impressive net worth.

In the next section, we will explore Chris Valletta's philanthropic endeavors and the impact he has made through his charitable work.

Chris Valletta's journey to a net worth of $20 million is a testament to his entrepreneurial acumen, investment savvy, and commitment to long-term growth. His focus on identifying undervalued assets, capitalizing on market trends, and managing risk has been instrumental in his financial success. Valletta's investment philosophy emphasizes thorough research, diversification, and patience, providing valuable insights for aspiring investors.

Two key takeaways from Valletta's approach are the importance of embracing disruptive technologies and investing for the long term. By recognizing the transformative power of technology and seeking companies with strong fundamentals, he has positioned himself to benefit from emerging trends. Additionally, his discipline and patience in investing have allowed him to ride out market fluctuations and achieve substantial returns.

ncG1vNJzZmibmJ67pr%2FEZ5imq2NjsaqzyK2YpaeTmq6vv8%2Bamp6rXpi8rnvCoamiq12rrq24xK2rmmWemsFuw86rq6FlmKTEb7TTpqM%3D